Thomas Edison once famously said, “The value of an idea lies in the using of it.”

While insurance certainly is reaping the benefits of new ideas, innovation has been slow to trickle down to the foundations of the insurance industry and its many facets. In contrast to auto insurers, who have been able to ride a data wave replete with VINs and driving records, commercial property insurers have been drastically underserved by the Insurtech revolution, especially when it comes to property inspection. Industry studies show that 75% of commercial buildings are underinsured, highlighting a fundamental problem with the valuation process.

Underwriters, particularly those working with commercial property, are suffering from a lack of reliable data. Far too often, this is evident in the quality of the policies that are delivered to insureds. The complexities of the risk, poor assessment tools, and faulty information only exacerbate the problem.

At Tensorflight, we believe the time has come for commercial underwriters to be equipped with state-of-the-art tools and the best available data.

Existing Challenges in Commercial Property Estimation

While technology has transformed the insurance industry, the pace of change is slow, and has yet to make a meaningful impact on commercial underwriting. Here are several challenges underwriters still face:

Inconsistencies in Basic Information

Underwriters don’t always get the basics right. This is because the industry itself hasn’t been entirely digitized, and data collection often remains antiquated. Essential details like building age, external finishes, and business names themselves are often misidentified.

It’s important to note that this erroneous information often comes from business owners themselves, who sometimes fail to update their details when weneeded. Still, many insurers are willing to accept “good enough” rather than precision. There are reasons for this mindset; the lack of time and resources, as well as a lack of awareness that better solutions are available, can lead an underwriter to work with rough approximations rather than accurate data.

It’s easy to see how these shortcomings can be amplified when such data is run through an automated system, particularly when that data is being used to influence trends on other properties. Different techniques are appropriate for different types of properties. Some properties (such as schools or storefronts) have characteristics that can be easily replicated and are thus suitable for Artificial Intelligence, while more unique and complex buildings (such an automobile manufacturing plant) require the finesse of a human analyst.

Overly Complex and Inflexible Tools

Although there has been digital innovation in the insurance industry, much of it is “more sizzle than steak.”

Many modern tools that are designed to provide underwriters with more accurate data are overly complex; their deliverables are long on raw data but short on explanations of what the information means and how to make use of it.

Many of these tools are repurposed from other Insurtech models. As a result, they’re not genuinely tailored to the needs of property insurers. Ultimately, the biggest hurdle underwriters face may well be this lack of flexibility in the tools they are using.

Invalidated Risk Signals

Underwriters rely on the data they receive to build insurance products. However, the quality of the data used in commercial insurance is known to be wildly inconsistent. It’s not uncommon for basic data points like layouts, building age, and construction type to simply be incorrect. Variable data points, such as business type, property features, and business activity, are notorious for being months or even years out of date.

The quality of this data is often dependent upon the insured updating their policy when there is a material change of risk; however, many avoid doing so, especially when they suspect that being forthcoming with this information could adversely impact their renewal premium.

Human Error

To err is human, but it would be unfair to say that the fallacies of humans are entirely unavoidable. The truth is that even the most straightforward data is open to some degree of interpretation, depending upon the human that’s interpreting it. When those interpretations are then used to design an insurance product (which, in turn, influences the development of other insurance products), even minor variations often result in colossal differences.

Wrong Property Risk Information

It’s not unheard of for providers to furnish data containing invalidated risk signals. For example, providers may show that the roof of a property contains asbestos, while neglecting to mention that it’s inspected regularly. This leads to insurers utilizing outdated or inaccurate information. Other examples are reliance upon prior sale prices that fail to account for fluctuations in the real estate market, or underwriters taking information at face value from insureds who are not clear about the uses of rental properties they own.

When this happens, carriers need to determine whether the data can be corroborated or adjusted to reflect changes in market conditions. At times, the data may not be of any value at all. This creates uncertainty for the insurers around the importance and validity of such data within their framework.

The current situation

Make no mistake: large commercial insurance firms do innovate. However, climate change and the rise of AI are significantly impacting the way in which they do so.

The demand for sustainable building is on the rise. Materials that are questionably ‘green’ like virgin wood, and those that require mining, like iron ore, are falling out of favour. Materials like reclaimed wood and recycled steel are gaining in popularity. Large commercial insurers are being pushed to find ways to ensure that a building made of second-hand materials poses no less of a risk than one made from new materials. Another consideration is the proliferation of solar panels, which can impact a property’s Total Insurable Value.

Similarly, AI is at the core of innovation for commercial insurers. This innovation is readily apparent in claims processing, long notorious for its lack of speed. AI is being used to accelerate the claims handling process, as agents find that they are more easily able to assess coverage, communicate via a client portal, and ultimately reduce cycle times.

These enhancements are intended to improve policyholder satisfaction. However, using AI to process a claim does little to relieve the frustration of the parties if the data used to create that policy comes from an inaccurate building inspection. Simply put, larger commercial insurers are devoting a lot of time to meeting the demands of the customers, while often neglecting the needs of underwriters. The problems associated with reliance upon faulty data need to be addressed at their source.

Tensorflight at Work

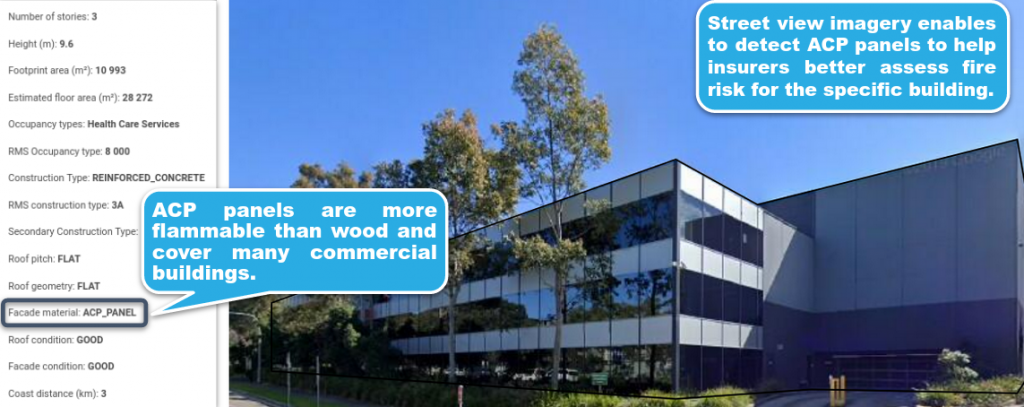

The way Tensorflight tackles the challenges in commercial property inspection and underwriting gets to the root of the problem. By providing insurers with more robust data points and ensuring that those data points are current, underwriters can more accurately estimate the risk of insuring commercial property. Facade material and condition, construction type, replacement cost, occupancy type, and roof geometry are just some of the regularly updated data sets that are delivered to your software to enhance your insurance products.

By combining superior satellite, aerial, and street-level imagery with our proprietary Artificial Intelligence engine, Tensorflight simplifies your commercial property inspections. The end result is a reduction in premium leakage, instant and automated policy quotes, improved loss ratios, a significant decrease in onsite inspection costs, and more efficient claims handling.

Our process

Our product uses satellite, aerial, and street level imagery combined with building records and AI algorithms to automate commercial property inspections and claims processing

With Tensorflight, the cost of in-person property inspections can be reduced by 25%+ and can lead to a tenfold increase in efficiency of the claims handling team.

Below are some use cases provided by Tensorflight for commercial property detection:

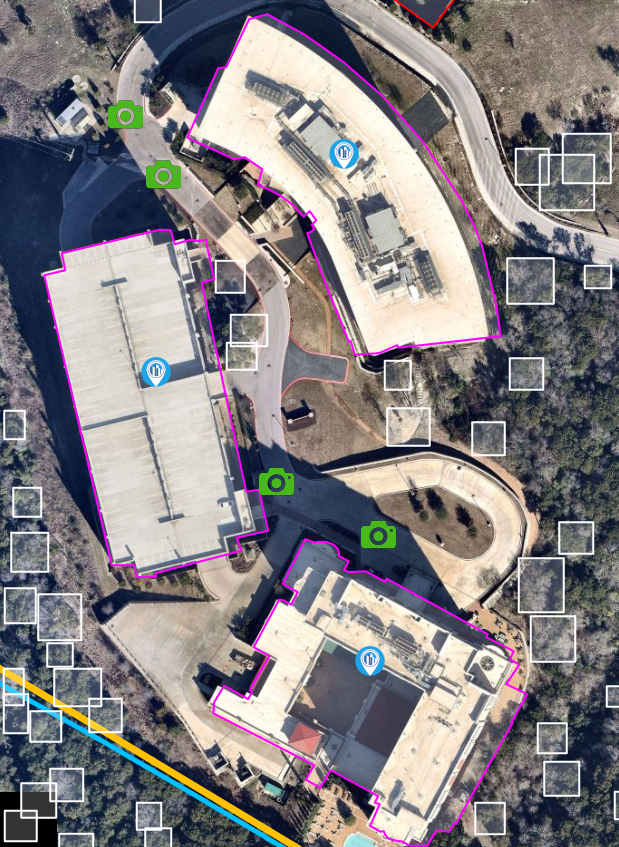

1. All buildings are highlighted and analysed.

2. All portfolio can be analyzed in one day.

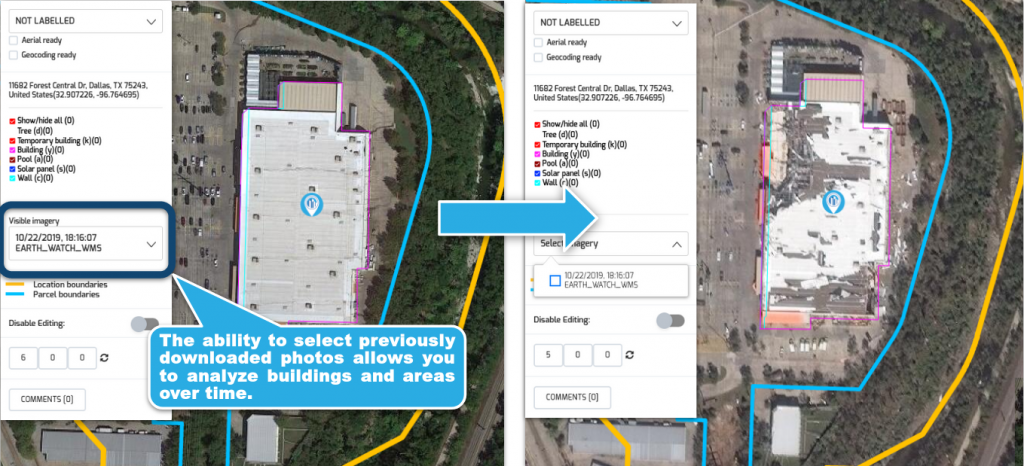

3. Claims tool: pre and post event comparison.

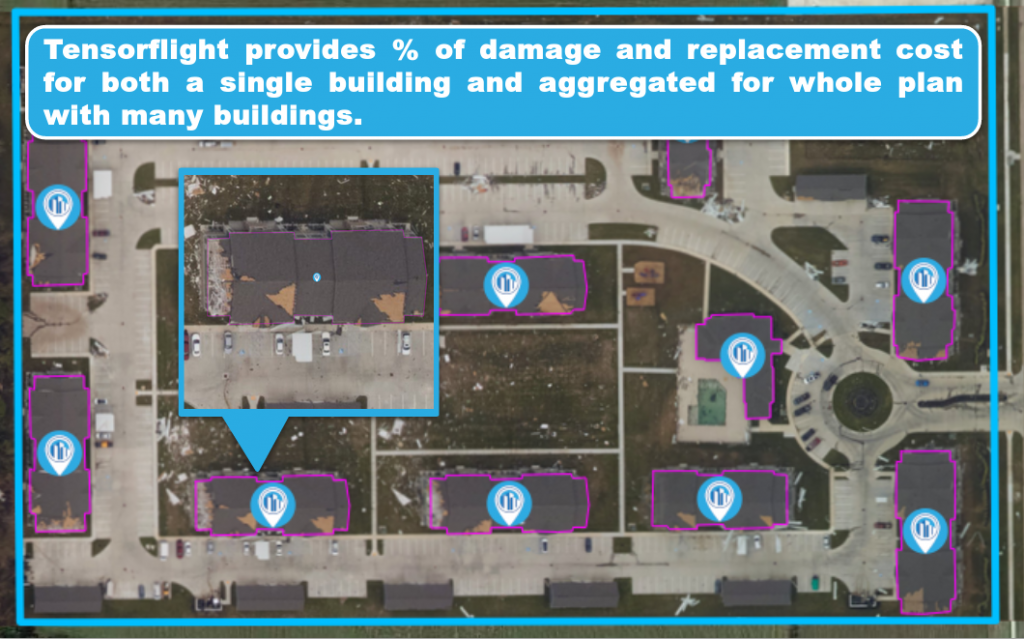

4. Claims tool: buildings damage estimation.

5. Ground level street view images allow for facade material, including ACP panels ACP.

More likely than not, you’ve incurred the costs associated with on-site inspections, or have suffered the consequences of premium leakage which results from insufficient and incomplete data. You also recognize that these are rarely isolated incidents, and that the cumulative effect of these “rounding errors” is that it becomes harder and more costly to vet the quality of the data that your existing policies are built upon.

Implementing Tensorflight in your current workflow not only lowers your overhead by reducing property inspections; it also gives you peace of mind knowing that your underwriting is based upon solid data, which translates to avoiding unexpected costly claims and improving loss ratios. With more accurate measurements of risk, you can design insurance products that will remain financially sound, now and for years to come.

Tensorflight’s technology enables a new future, where underwriters inspect commercial properties in a new, more accurate, and more efficient way.