The landscape of American real estate is vast and complex. A critical issue can go unnoticed until it unfolds into a financial catastrophe for many. It’s the underinsurance of buildings.

This problem affects a significant number of property owners across the nation and exposes them to severe financial risks. Particularly in the aftermath of unexpected disasters.

A scenario where the insurance coverage is insufficient to cover the cost of rebuilding or repairing, leaves property owners in a tough position, often only aware of the risk once it’s too late.

Recent studies shed light on the magnitude of this issue. A revealing report by United Policyholders underscores the severity of the situation. It indicates that a staggering two-thirds of homeowners in wildfire-prone areas are under-insured, potentially facing financial ruin in the event of a disaster. This data not only highlights the widespread nature of the problem but also signals an urgent need for solutions to mitigate these risks effectively.

As we delve deeper into this issue, we’ll explore the roots of the problem and its consequences for property owners and property underwriters. We will look at the rise of innovative solutions, such as Tensorflight, which are making strides in resolving this industry-wide challenge.

Defining Underinsurance

Under-insurance in property insurance occurs when the coverage amount of an insurance policy falls short of the property’s actual replacement cost. This disparity means that in the event of damage or loss, the insurance payout will not be sufficient to cover the cost of rebuilding or repairing the property to its pre-loss condition.

The consequences of this gap can be financially devastating for property owners, who may find themselves burdened with the majority of repair or reconstruction costs due to inadequate coverage.

This issue often stems from various factors, including a lack of regular property valuation updates, the rapid appreciation of real estate values, and the complexities and misunderstandings of insurance policy terms. Recently, the issue more often lies in bureaucratic procedures, and lack of time and human capital within insurance companies. The challenge is not just in recognizing the existence of under-insurance but in the inherent difficulties in accurately assessing and updating property values in a constantly fluctuating market.

The Extent of the Problem

The prevalence of underinsured buildings in the United States is not just a concern. It’s a widespread issue affecting a substantial number of properties and, by extension, their owners. The previously mentioned study by United Policyholders is just one piece. It’s evidence points to the gravity of the situation. Another study, conducted by the Insurance Information Institute, highlights that under-insurance is a critical issue nationwide, affecting properties in various locations and of different types, not just those in high-risk or disaster-prone areas.

The statistics tell that a significant percentage of commercial properties are also at risk of being underinsured. This could lead to billions of dollars in uncovered losses in the event of a major catastrophe.

This issue transcends residential properties and is a concern for businesses and commercial stakeholders, underscoring the need for a comprehensive approach to address under-insurance across all property types – according to a study by Atlus Group, 75% of commercial buildings are underinsured, and professionals who assess building replacement costs frequently find instances of properties that are over-insured.

The scope of under-insurance is vast, impacting not only individual property owners but also the broader economy. Especially when large-scale disasters strike and reveal the extent of underinsured properties. The aftermath of such events often brings to light the critical need for accurate property valuations and adequate insurance coverage to safeguard against financial ruin.

Risks and Consequences of Underinsurance for Property Owners

Under-insurance brings significant financial and emotional risks for property owners. Financially, it means that in the event of damage or loss, the insurance payout may not cover the entire cost of repair or replacement, leaving owners to bear the brunt of the remaining expenses. This situation can lead to severe economic strain, particularly for those not prepared for such out-of-pocket costs. Emotionally, dealing with the aftermath of a disaster and the stress of insufficient coverage can be overwhelming, compounding the trauma of property loss.

Industry Impact

The underinsurance issue profoundly affects the insurance industry. Insurers face increased claim disputes, customer dissatisfaction, and potential reputational damage when the coverage falls short of policyholders’ expectations. Moreover, the industry must navigate the financial implications of under-insurance, especially when large-scale disasters highlight the extent of the coverage gap. For instance, 2023 has been marked as a year with significant insured losses due to severe convective storms, impacting both property owners and the insurance sector as found by the Insurance Information Institute.

Addressing Underinsurance

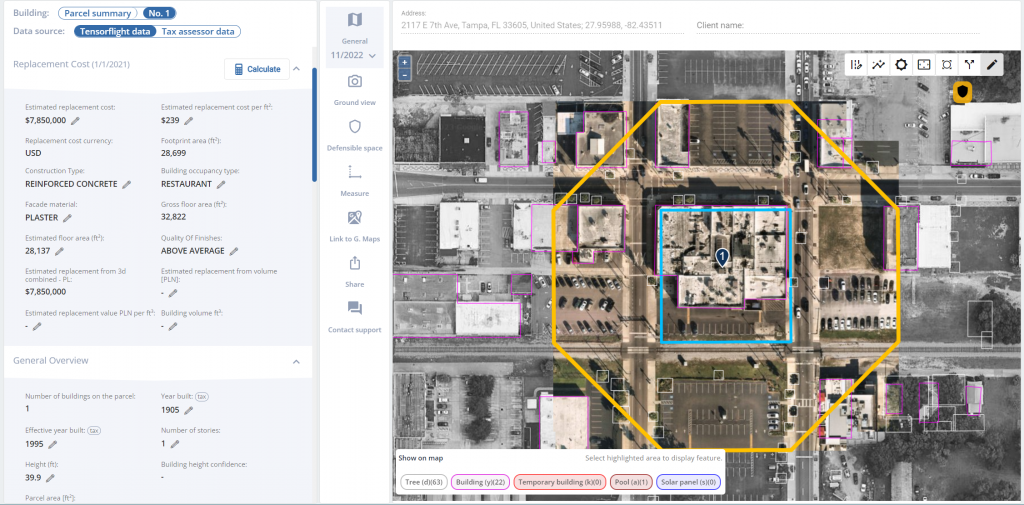

AI, Machine Learning, and Computer vision combined with satellite, aerial, and ground-level imagery. Tensorflight’s solution can provide accurate property valuations across 95% of North America. This innovation allows for more precise insurance coverage, aligning policy values closer to the actual worth of properties.

For insurers, Tensorflight’s technology means improved risk assessment and underwriting accuracy, reducing the prevalence of under-insurance. Property owners benefit from coverage that more accurately reflects their property’s value, offering better protection and peace of mind in the face of potential disasters.

By integrating advanced technologies into the property valuation process, Tensorflight is helping to reshape the insurance landscape, making it more responsive to the actual needs of property owners while also providing insurers with tools to manage risks more effectively.

Precise Replacement Cost Data for Cost and Time Reduction

To address underinsurance effectively, Tensorflight created a comprehensive AI-based Replacement Cost feature. This tool leverages advanced algorithms and a vast database to provide accurate estimates of a property’s replacement cost, crucial for ensuring adequate insurance coverage.

By integrating this feature, insurers can align policy values more closely with actual property values, mitigating the risks associated with underinsurance. Our Replacement Cost Calculator further refines this process, offering a user-friendly interface for quick and precise cost estimations, essential for both insurers and property owners seeking reliable insurance coverage.

Tensorflight is not just replacement cost – we empower insurers and underwriters through over 40 property attributes and a wide range of product features, powered by advanced technology, and embedded into underwriting platforms.

Tensorflight and PZU – Solving Underinsurance

We are dedicated to providing precise replacement cost estimations, vital for addressing underinsurance in the industry. Our collaboration with PZU, a prominent financial institution in Central and Eastern Europe, renowned for its comprehensive range of insurance offerings, illustrates our commitment to this goal. We empower PZU with our advanced AI-driven tools to accurately assess the value of commercial properties, enhancing their ability to determine correct insurance coverages.

You can learn more about how we help insurers around the world here.

Providing Solutions, Solving Problems

Tensorflight’s advanced technology offers significant benefits for both insurers and property owners. For insurers, the precise property valuations provided by Tensorflight enhance risk assessment and underwriting processes, leading to more accurate policy pricing and reduced exposure to underinsured claims. This precision aids insurers in offering policies that are more closely aligned with the actual value of properties, fostering a more sustainable and financially stable insurance environment.

Property owners, on the other hand, gain peace of mind knowing their coverage is based on accurate and up-to-date property valuations. This ensures that in the event of a loss, the insurance coverage will be more reflective of the actual costs to repair or rebuild, mitigating the financial burden on the property owner. Accurate valuations mean that owners are neither overpaying for excessive coverage nor at risk due to under-insurance.

The integration of technology like Tensorflight into the property insurance sector is just the beginning. The innovations in AI, data analytics, and remote sensing will continue to evolve, offering more granular insights into property risks and enabling more personalized and accurate insurance solutions.

Conclusion

The challenge of underinsured buildings in America is a multifaceted issue with far-reaching implications for property owners and the insurance industry. Through the utilization of advanced technologies like those offered by Tensorflight, there’s a promising path forward to address this issue.

Accurate property valuations ensure that insurance coverage aligns more closely with actual property values, mitigating the financial risks for property owners while enhancing the stability and reliability of the insurance sector. As we move forward, the continued integration of innovative technologies in insurance practices signifies a proactive approach to risk management, promising a future where the perils of under-insurance are significantly diminished.

For property owners and industry professionals seeking to navigate the complexities of under-insurance, the time to act is now. Explore how Tensorflight’s solutions can benefit you and your business, save time, and drive profits – contact us now.